Part 3: The Data Trap

Why Executives Trust Tangible Layoffs Over Intangible Brand Value

Author’s note: this is a series on The High Cost of Cheap AI Art. Click here for Part 1.

To understand the decision to cut both the art department budget in Part 1 and the marketing budget in Part 2, you have to visit the Executive Boardroom, the domain of Harlan Brandwell, the CEO of Omni-Toy Global. Brandwell started his career as a brand manager at a consumer-packaged-goods conglomerate, where he made his name selling the Tuff-Pup Indestructible Squeaky Bone. This early success left him with a distorted but deeply held belief that children and golden retrievers are essentially the same demographic: simple creatures who just want a durable object that makes a noise when you squeeze it.

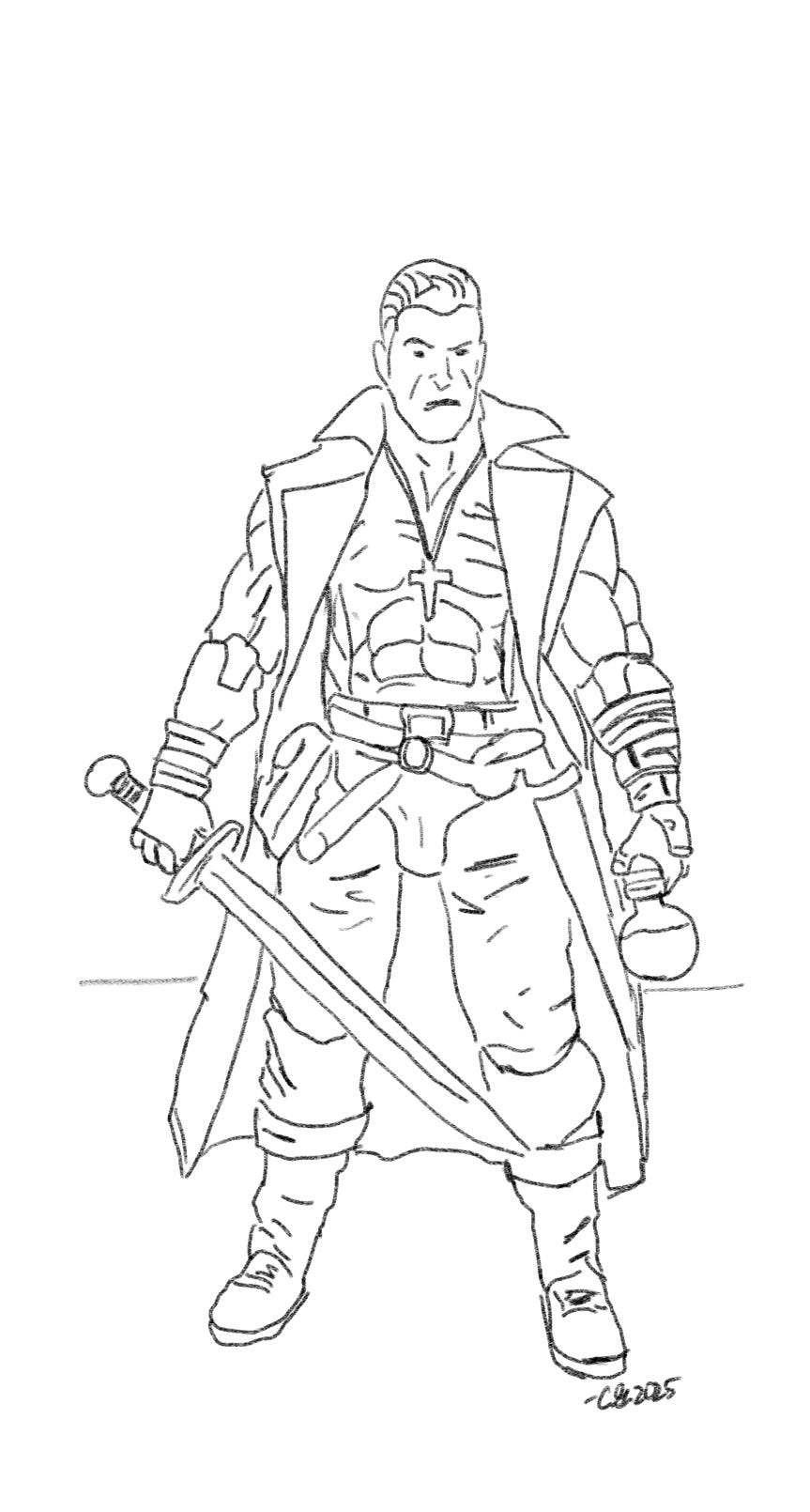

Opposite him sits Dr. Quant, the Chief Data Officer. Dr. Quant is a former academic who treats the toy business like one of the referee reports that ended his career. Over the last three years, he has convinced Brandwell to hire an army of twenty Machine Learning PhDs to build the “Omni-Pulse Sentiment Index,” a proprietary, in-house brand health tracker. His merry band of PhDs scrapes millions of TikTok comments and runs them through a classification pipeline powered by Large Language Models (LLMs are the tech behind ChatGPT). This ostensibly gives marketing a real-time heartbeat on the vibes surrounding the Commando Kyle™ action figure.

The PhDs adore the Omni-Pulse project. It gives them LLM experience, which they hope to leverage into potential roles at the frontier labs (whose gold-dusted equity packages are worth more than their entire salaries at the toy company).

On the wall, a PowerPoint slide displays two trend lines:

Green (Cost Per Unit) gliding down gracefully.

Red (Omni-Pulse Sentiment Index) plummeting like a dying bird.

Brandwell squints at the red one. “Explain this, Doctor. Why do the children hate Commando Kyle? We made him 40% cheaper to produce. That is efficiency. Children love efficiency.”

Dr. Quant looks pained. “Well, the Natural Language Processing model is picking up high-frequency terms like ‘Soulless’ and ‘Nightmare Fuel,’ but the semantic context is ambiguous.”

Brandwell brightens. “Nightmare Fuel? Could that be referring to the Commando Kyle: Vampire Hunter SKU? That is a positive sentiment, right?”

“Well, potentially,” Dr. Quant says, scrolling through his tablet. “However, the cluster analysis is also associating ‘Nightmare Fuel’ with terms like ‘Melting,’ ‘Slop,’ and ‘I want my money back.’ The model is struggling to differentiate between positivity from our Halloween limited editions and negativity caused by a manufacturing defect.”

Brandwell frowns, stressed. He is unconsciously squeezing a Tuff-Pup prototype in his hand. Squeak. Squeak.

“I have twenty geniuses on your payroll, and you can’t tell me if the customers are scared of the toy or scared for the toy?”

“Human emotion is remarkably resistant to linear modeling,” Dr. Quant says defensively. “We need to fine-tune a new LLM to distinguish ironic fear from genuine revulsion. I’ll need budget for six more data scientists.”

Brandwell squeezes the dog toy hard. SQUEAK.

With a sinking feeling, he realizes that his expensive Data Science division can’t tell him if he is destroying his company.

So, Brandwell looks back at the screen.

He looks at the Red Line (Brand Sentiment). It is fuzzy. It is academic. It is a problem for Future Brandwell.

Then he looks at the Green Line (Cost Savings).

“Doctor,” Brandwell snaps, pointing to the Green Line. “We saved $4 million this quarter by firing the offshore vendors and switching to AI. That is a hard number. I can buy a boat with that number. It is intellectually very honest.”

“Mathematically? Yes,” Dr. Quant concedes. “The cost savings are absolute. The brand damage is... theoretical.”

Brandwell nods. The tension leaves his shoulders. He retreats to the safety of the only metric he understands.

“So, if we ignore the Red Line, since you can’t measure it anyway, we are having a record quarter?”

“If you exclude the intangible variables? Yes.”

Brandwell smiles, the smile of a man who knows how to hit a quarterly target. “Excellent. Ignore the ‘Nightmare Fuel.’ Let’s authorize a stock buyback.”

The Economic Reality:

This is the Data Trap. In the corporate world, the maxim is “What gets measured gets managed.” It is easy to measure the $80,000 you saved by firing a Senior Artist. It is very difficult to measure the millions you lost because a generation of kids decided your toy was cringe.

When a company enters a contraction cycle, executives like Brandwell cling to the “Hard Data” (Cost Savings) because it is concrete, actionable, and guarantees them a bonus today, even if the “Soft Data” (Brand Destruction) guarantees bankruptcy in five years.